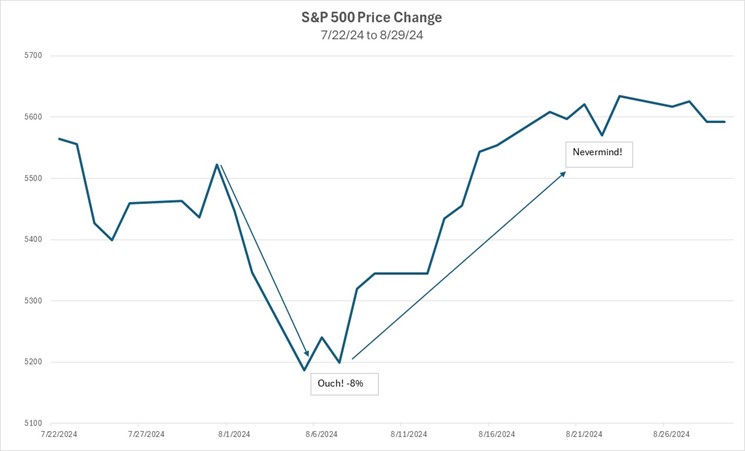

If you blinked, you missed it. Between August 1st and August 5th, the S&P 500 dropped 8%, only to see those losses erased by mid-August.

(Source: Bloomberg)

What caused the precipitous decline? As usual, the answer is complicated. Since mid-July, the equity market, already characterized by a lack of volatility and very heavy ownership in technology stocks, faced several other short-term headwinds: a rise in unemployment, weak macroeconomic data, and growing concerns about the Fed’s pace of rate cuts.

One additional catalyst – which was cited ad nauseum by market analysts – was the reversal of the “yen-based carry trade”. In almost-plain English, here’s what happened:

The “yen-based carry trade” involves borrowing money in a currency with a low interest rate (e.g., the yen) and investing the proceeds in assets with the potential for higher returns, such as U.S. mega-cap technology stocks. The goal is to profit from the difference while also hoping for favorable exchange rate movements. Carry trades are popular among institutional investors and hedge funds during stable, low-volatility periods, but they can quickly prove unsuccessful when one or both sides of the trade face pressure, for instance a change in interest rates.

And that is precisely what happened this summer. The investing world was rocked at the end of July when the Bank of Japan raised interest rates by 0.25%. While seemingly modest, this increase led to a rapid strengthening of the yen which, in turn, triggered massive margin calls demanding either additional collateral or repayment to shore up the loans financing these trades. Bowing to these pressures, Japan’s TOPIX stock market index dropped dramatically by 20% in one trading session, contributing to a global market selloff that included a 3% decline in the S&P 500 on August 5th. It was a notable flight to safety – something we haven’t seen in a while.

A few days later, the Bank of Japan backtracked, stating it would refrain from further rate hikes while “markets are unstable.” In other words, “oops.” This statement helped stabilize the currency and overall market volatility. By mid-August, equities had mostly recovered, and everyone’s attention had shifted away from the carry trade. That said, carry trades, whether in yen or any other currency, will persist as long as there are opportunities for profit.

This recent experience highlights a few things to keep in mind as investors. First, it reminds us of the interconnected nature of global finance, as even those who don’t engage in currency trading or any type of carry trade were affected by the market correction. Second, it underscores the importance of HCA’s active approach to investment positioning. Fixed income acted as a hedge against equity volatility during this carry trade meltdown, supporting both our thesis that fixed income is regaining status as a haven and our efforts to increase portfolio weighting to bonds. Finally, it is important to keep in mind that the average historical S&P 500 intra-year decline is about 14%. As long-term investors, we must know that drawdowns or corrections are a normal part of the investing process, not the outlier, and to be prepared to weather market storms.