Challenging Venture Markets Still Offer Long-Term Returns Potential

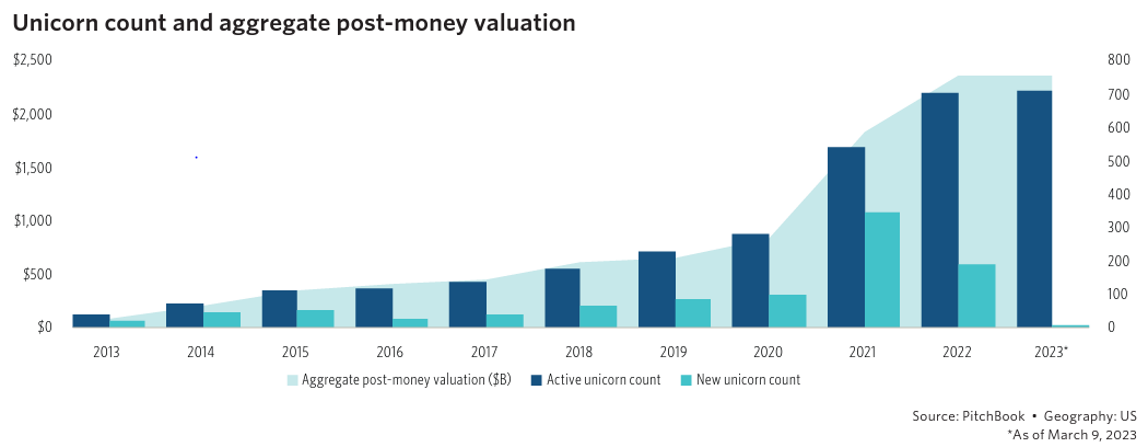

Unicorns have been on the rise… not the mythical creatures, sadly. I am talking about privately held companies valued at $1 billion or more. The term “unicorn” was originally coined in 2013, at which time there were just 39 private companies in the billion-dollar club. Since then, more than 1,000 unicorns have graced the world, with over 700 appearing in the U.S. alone – 534 since 2021.

To be clear, unicorns are not unicorns because they are generating billions of dollars in revenue. Rather, they attain high valuations because of large investments by venture capitalists. Typically, venture money is invested through multiple rounds of fundraising in the hope that the growth potential of a unicorn will ultimately drive a lucrative exit. For example, despite losing $138 million and bringing in just $10 million in revenue in 2013, the messaging application What’s App was acquired by Facebook/Meta for $19 billion in 2014 – (essentially an acquisition of What’s App’s enormous userbase).

Here are some fun unicorn facts:

- Fintech is the largest category, accounting for roughly 1 in 5 unicorns (21%), followed by internet software and services (19%), e-commerce and direct-to-consumer (9%), and health (8%).

- The top five most valuable unicorns as of Q4’22 included TikTok owner ByteDance ($140Bn), aerospace manufacturer SpaceX ($127Bn), fast fashion company SHEIN ($100Bn), payments processor Stripe ($95Bn), and collaborative online design tool Canva ($40Bn).

- The U.S. has more unicorns than the rest of the world combined, representing over 10% of U.S. GDP.

Source: CB Insights and Pitchbook.

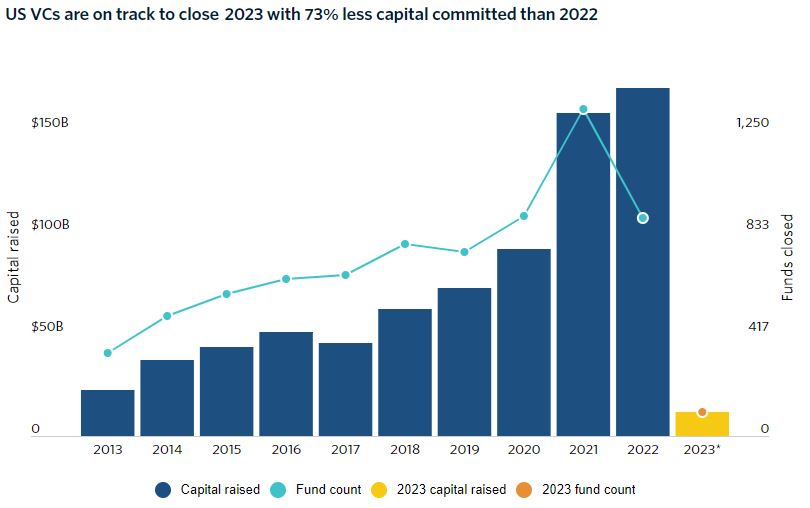

So, what drove the explosive growth in private companies with billion-dollar values in 2020 and 2021? Looking at the top three unicorns, you would think it was Elon, teens and tweens. The reality is that the growth was driven by innovation in the evolving venture ecosystem coupled with increasing levels of available funding (hedge funds like Tiger and Coatue entered the arena), permitting these companies to stay private longer. Furthermore, low interest rates during this time meant a lower overall cost of investing, driving an increase in capital deployment, particularly into higher risk/higher return opportunities.

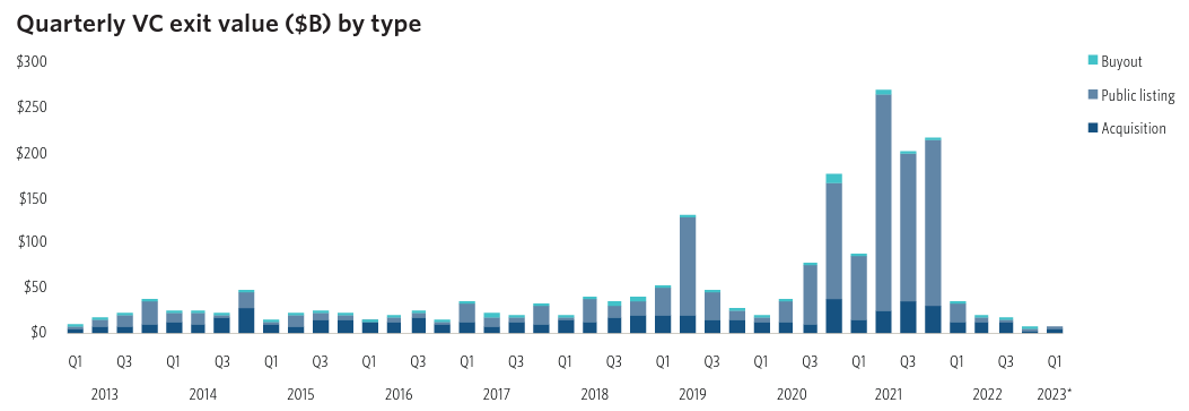

Valuations took a turn in 2022, which was largely viewed as one of the toughest environments on record for venture investing. The NASDAQ was down 34% for the year, public listings (IPOs) for VC-backed companies dropped to their lowest level since 2016, and there were only five unicorn acquisitions in 2022 vs. 24 and 17 in 2021 and 2020, respectively. The challenging conditions for M&A activity continued into Q1 2023, with M&A volume totaling just $3.7 billion, the lowest quarterly value seen in the past decade.

Markets go through cycles and the venture capital market will eventually regain its footing. But the stakes are higher in giant deal making – what if the unicorn turns out to be a plain white mare or, worse still, a donkey (Theranos…)? For those who have read Peter S. Beagle’s book, The Last Unicorn, you know the ordinary folk in the book can’t see the unicorn – they just see a horse. (As an aside, if you haven’t read the book or seen the animated film, you are missing out.) Conversely, the venture world is driven by “extraordinary” investors who believe they can spot the unicorn among the herd of white horses.

While venture activity may remain depressed in 2023 due to market uncertainty, high-quality companies backed by experienced fund managers with dry powder and strategic vision should continue to thrive and prepare to capitalize on market windows. IPO market and M&A activity should rebound as inflation moderates, rate hikes slow/reverse, public growth stock performance improves, and earnings estimates stabilize. Venture capital remains a critical source of funding for innovation, as well as a viable way for sophisticated investors to earn outsized returns. Eventually, the valuation tide of the unicorns should rise again.