Are you leaving money on the table?

It’s likely that your bank needs more money.

Let me clarify…

This isn’t a criticism directed at any particular bank. But we currently live in a world with significantly higher interest rates compared to just 12 months ago. Consequently, banks may require more capital due to the increased costs associated with their operations.

One method for a bank to attract more money is to raise its deposit, or savings rates. These adjustments are typically made based on factors such as shifts in the Federal Open Market Committee (FOMC) interest rate, competitor analysis, market share, and more.

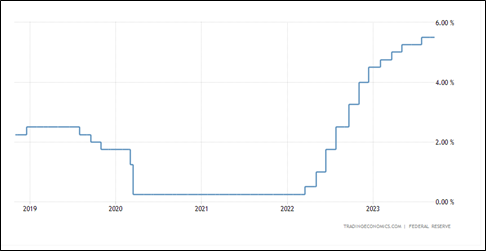

Taking a step back, the Federal Reserve’s (the Fed) actions since the Global Financial Crisis have made it nearly impossible to spot attractive savings account rates without a magnifying glass. When the Fed slashed rates to 0%, it was essentially encouraging people to spend or invest. However, in response to the urgent need to combat inflation following the COVID-19 pandemic, the Fed has increased rates several times and may consider raising them once more. The Fed’s change in direction signals that they would like you to save a little more to cool the economy.

Here is the change in Fed policy rate, .25% to 5.5% since March ‘22:

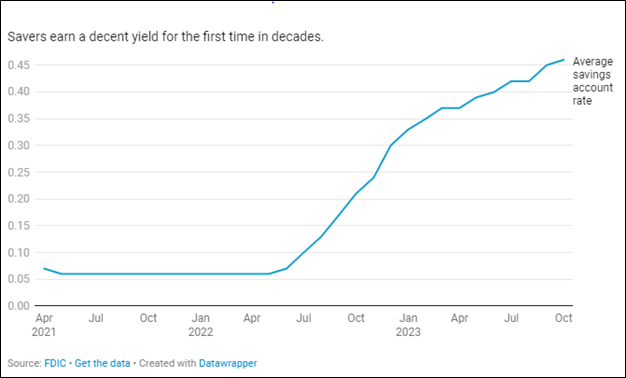

Here’s the part that should grab your attention or even make you a little frustrated: most banks assume that you aren’t closely monitoring your finances, let alone what the Fed is doing. They believe that you have more pressing matters to attend to, and thus, banks tend to increase rates only by a small margin, just enough to limit the outflow of funds.

As you can see in the charts below, the historical savings interest rate was both negligible and flat for a very long time. The average savings interest rate in the U.S. today is still well less than 1%, but you could be earning 4% to 5% plus at certain banks. This data should inspire you to take advantage of the uptick in rates, while also possibly infuriating you that the national average is so low.

So, do you know what your cash is earning today? Are you earning a rate close to the national average, or are you banking with an institution that offers considerably better rates? Today’s top savings accounts are providing Annual Percentage Yields (APYs) as high as 5.25%. The term “high-yield savings account” was coined by the banking industry, and while it lacks an official definition, it essentially means what it sounds like – an account that offers significantly higher returns. (There may be some strings attached, like a minimum balance or linking your checking account to your savings account.)

While there certainly is effort involved – to identify a higher-paying option and shift some funds around – we do think it is time well spent. Think about it this way: if you have $10,000 in cash, you could earn an extra $500 annually by taking a small amount of time to explore your options.

Having said this, one thing to keep in mind is the potential risk inherent in placing deposits in any financial institution. As you explore options for your excess cash, be mindful of safety and consider the role of insurance. The recent collapse of Silicon Valley Bank brought the Federal Deposit Insurance Corporation (FDIC) back in the news. Wherever one banks, it is important to remember that FDIC deposit coverage is limited to $250,000 per depositor, per FDIC-insured bank, per ownership category.

If you need a place to start, try this link, but importantly one should do their own research while keeping in mind some important guidelines. The first thing to look for on any bank website is the FDIC insignia, usually at the bottom of the landing page. That means the potential depositor has the FDIC insurance protection outlined above. Second, it may be tempting to chase the highest yield, but there are of course trade-offs. Some of these banks don’t have “brick and mortar” branches or other customer-service attributes of larger institutions. Finally, there are roughly 4,000 different banks in the US, inevitably due to the stress higher rates have put on some of these banks, there will be mergers. So, in that case an account at the one bank may end up at a new bank because of an acquisition.

We are here to discuss this quest for higher cash yields further. And, if you have a great tip about a safe bank with terrific returns on savings, please pass it along!