If you have philanthropic inclinations and large capital gains in your investment portfolio or expect an unusually high-income year, you might want to consider a tax-advantageous way to give to your favorite charities: a Donor-Advised Fund (“DAF”). A DAF is essentially a charitable investment account enabling simplified, flexible, and tax-efficient charitable giving. Among other advantages, a DAF allows you to gift appreciated assets without incurring capital gains taxes, be eligible for an immediate tax deduction in the year of contribution and make grants from the fund to your preferred IRS-qualified public charities at your convenience over a period of months or years.

How Does It Work?

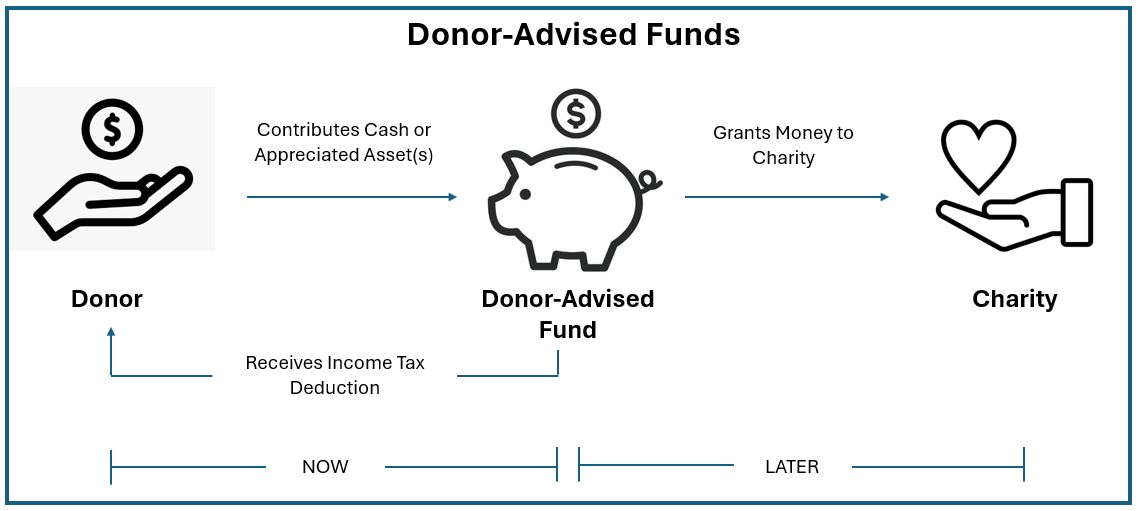

A contribution to a DAF is treated as a gift to a 501(c)(3) public charity, making the donor eligible for a charitable deduction of the fair market value of the contributed assets, limited to 60% of adjusted gross income (“AGI”) for cash gifts and 30% of AGI for appreciated securities. The process at a high level is as follows:

- Give – A donor establishes an investment account with a sponsoring organization, such as Schwab Charitable or Fidelity Charitable, and donates cash or appreciated assets to the account. As with direct gifts to charities, the contribution is irrevocable.

- Grow – The assets in the donor’s account can be invested until the donor is ready to make charitable distributions, resulting in the potential for tax-free growth in the meantime. Investment solutions are offered by the sponsoring organization and can be selected by the donor (or investment advisor on behalf of the donor).

- Grant – The donor directs the sponsoring organization to make grants in specific amounts to charities of the donor’s choice (subject to some restrictions depending on the sponsor).

What are the Benefits?

Here are a few of the key reasons that people and businesses utilize DAF accounts for charitable giving:

- Tax benefits – by donating long-term (held for more than a year) appreciated assets to a DAF, you generally won’t have to pay tax on the capital gains, and you can take an income tax deduction in the amount of the full fair-market value of the asset (subject to the AGI limitations mentioned above).

- Ability to donate a wide range of appreciated assets – DAFs accept contributions beyond cash, for example restricted stock, mutual fund shares, and cryptocurrency, while not all charities accept direct non-cash donations.

- Simplified record-keeping – if you typically donate to more than one charity, a DAF allows you to consolidate and keep track of your giving with just one tax receipt. Because grants from the fund to your chosen charities are not considered deductible gifts from you for tax purposes you won’t need to keep track of IRS-compliant receipts from each charity.

- Donations can grow tax-free – after contributing to your DAF account, your contribution can be invested to grow tax-free within the account, potentially increasing the amount you can ultimately grant to charities.

- Integration of philanthropy with estate planning – many sponsors permit accounts to be passed down to heirs, facilitating inter-generational charitable planning and involvement of extended family in philanthropic goals.

From a planning perspective, donors may consider “front loading” charitable contributions in a high-income year to maximize the impact of the tax deduction. For example, if you receive a large bonus, sell your business, or execute stock options in a given year, this would be a good opportunity to contribute to a DAF, take a full charitable deduction to offset this higher income/higher taxation, and subsequently make periodic distributions to charities over a number of years.

If you think a donor-advised fund might make sense as a part of your philanthropic, tax and estate planning, we’d be happy to help you explore the strategy and implement it, as appropriate, to support your goals.