In recent years, legislation addressing retirement planning has been a rare area of bipartisan cooperation, as lawmakers from both sides of the aisle have come together to address the lack of retirement preparedness in this country. In 2019, the Setting Every Community Up for Retirement Enhancement (SECURE) Act introduced a wide-ranging set of changes to the retirement landscape with an eye toward incentivizing savings and making retirement savings programs more accessible for all retirees. In December 2022, legislators continued to build on this work by enacting SECURE 2.0.

SECURE 2.0 contains over 90 provisions affecting retirement accounts, including both IRAs and workplace plans such as 401(k)s. Many of these provisions take effect over a number of years. While it is not feasible to list, let alone explain, all the provisions of SECURE 2.0, this piece will focus on some of the more innovative and potentially relevant provisions, as well as those that come into effect immediately.

Changes to RMDs

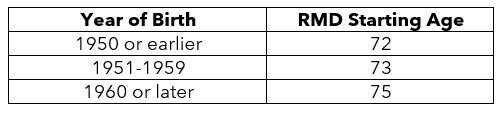

The earliest age at which an individual can start taking money out of their IRA or 401(k) without penalty remains 59-1/2, but the age at which an individual must start taking required minimum distributions (RMDs) from these accounts – or face a penalty for not doing so – is increasing to 73 in 2023 and then to 75 in 2033. The chart below summarizes the new requirements:

In addition, the penalty for failing to take an RMD has decreased from 50% of the missed distribution to 25% (10% if timely corrected).

Increases in Catch-up Contributions

There are limits to how much money a person can contribute to a retirement account each year. Those age 50 and over are eligible to make additional annual “catch-up” contributions to their 401(k) or IRA. Under SECURE 2.0, the maximum catch-up contribution to a workplace plan increases to $7,500 this year. Then, beginning in 2025, people ages 60 to 63 can make annual catch-up contributions up to $10,000.

Catch-up contributions to IRAs are still limited to $1,000 per year but will be indexed to inflation beginning in 2024, meaning this limit could increase every year based on cost-of-living increases. One caveat is that for anyone earning over $145,000 in a year, catch-up contributions can now be made only to a Roth account on an after-tax basis.

Retirement Plan Contributions and Student Loans

Beginning in 2024, employers will be able to “match” employee student loan payments with matching payments to a retirement account, giving workers an extra incentive to save while paying off educational loans.

529 Plan to Roth IRA Rollovers

Beginning in 2024, unused 529 plan assets in a 529 plan established 15+ years ago can be rolled over to a Roth IRA for the beneficiary, subject to annual Roth contribution limits and an aggregate lifetime limit of $35,000. Also, contributions made to the 529 plan in the last five years are not eligible for rollover.

Penalty-Free Early Withdrawals

There are many new circumstances in which people are permitted to take early distributions from retirement accounts without the usual 10% penalty. These include people certified by a doctor as having a terminal illness expected to result in death within 84 months (2023); domestic abuse victims (2024); payment of premiums on some long-term care contracts (2026); and several others, each with its own rules and limitations.

Additional Workplace Enrollment Opportunities

SECURE 2.0 encourages automatic enrollment of employees in workplace retirement plans (with the ability to opt out). Its provisions requiring businesses adopting new plans in or after 2025 to enroll employees automatically are subject to many exceptions but do represent movement toward stimulating broader participation of employees in retirement plans. In a similar vein, beginning in 2025, long-term part-time employees in some companies may be entitled to participate in the workplace plan once they have worked 500 hours in two consecutive years.

This is just a sampling of the many provisions of SECURE 2.0 that will affect retirement planning in the coming years. If you would like to know more about any of the provisions that may impact your particular circumstances, please reach out to your HCA team and we’d be happy to help.

By Elizabeth R. Hefferon