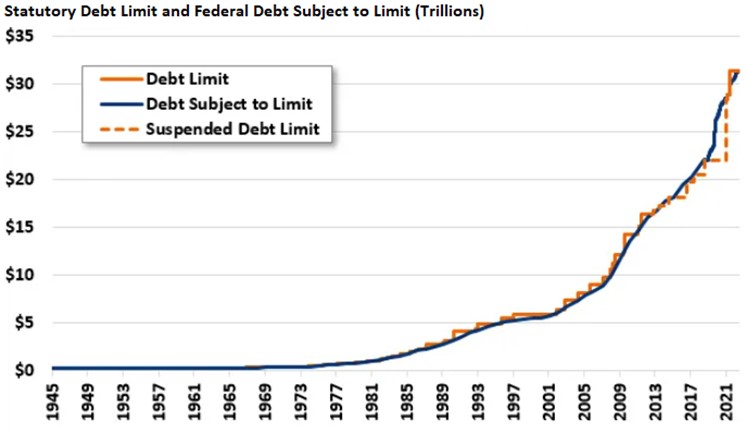

In January, the U.S. reached its $31 trillion national debt ceiling. Consequently, Treasury Secretary Janet Yellen implemented “extraordinary measures” to continue meeting the government’s obligations in the near-term. To most observers, this would seem like a looming economic calamity that would impact not only the U.S. but also the global economy. However, financial markets shrugged off the news, endorsing what many investors had already concluded: We’ve seen this movie before, and we know the ending – the debt ceiling will be raised.

Congress has raised or suspended the debt ceiling 79 times since 1960, and not once has the debt ceiling caused the U.S. to default on its debt. Unfortunately, it appears that the current Congress is approaching this situation through a partisan lens and with a strong propensity for brinksmanship.

While it is likely that Congress will strike a deal to increase the debt ceiling in the months ahead, a prolonged standoff in negotiations could be disruptive to federal operations and contribute to increased market volatility. The subject also tends to evoke a wide range of opinions (and emotions): “We’re mortgaging away our future!” or “We should spend more to improve our citizens’ quality of life!”

So how did we get here? Well, this uniquely American problem starts and ends with Congress. Congress introduced the debt ceiling during World War I to afford the Treasury more flexibility in issuing new bonds. The ceiling establishes an absolute dollar limit for the U.S. government’s debt. This practice is in stark contrast to that adopted by most developed countries, which instead anchor their debt ceiling to a designated percentage of GDP, allowing for fluidity as their economies evolve over time.

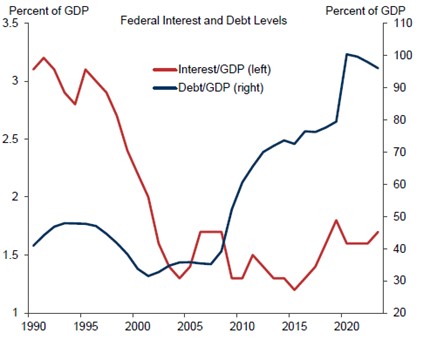

The most common framework for thinking about the nation’s debt is to view it like household finances. Most of us would agree that it is unsustainable (or potentially disastrous) for household expenses to exceed household income. However, the crucial difference between the U.S. government and a typical household is that, as a sovereign nation with control over its currency, the U.S. can issue new debt to meet near-term obligations. Furthermore, even more critical than the absolute level of debt is the government’s ability to make ongoing interest payments on that debt.

In this way, it can be useful to think of the public debt as a resource which can be leveraged during tough times and reined in during boom times. Indeed, most of the big increases in the national debt have occurred during recessions when government transfer payments such as unemployment insurance increase. Such government outlays act as an automatic stabilizer for the economy during downturns.

Over the past 20 years, the U.S. debt as a percentage of GDP has more than doubled. Although this has stoked concerns about an unsustainable trend, over the same timeframe the interest expense of servicing that debt has declined. If the economy is growing faster than the average interest rate of the debt outstanding, the overall debt level will be sustainable. However, if deficits continue to expand, interest rates rise, and the economy begins to shrink, the ability of the country to service this burden may be severely compromised.

The “extraordinary measures” implemented by Treasury Secretary Yellen should be sufficient to last until June, with the hope that Congress raises or suspends the debt ceiling by then. However, the negotiations could drag on through the second half of this year accompanied by ongoing news headlines filled with proclamations about who’s responsible for allowing us to get here. Keep in mind that, for the most part, this boils down to political theater and that the U.S. government has more flexibility to increase the deficit than many people realize.

There is no doubt that the economic effects of running out of available resources to meet federal government obligations would be negative, but there is a high degree of uncertainty about the speed and magnitude of the damage that the U.S. economy might incur. While the country has visited this precipice many times in the past, Congress and the Executive branch have been able to successfully negotiate a path by which to raise the debt ceiling. Our base assumption is that we will see that happen again at some point this year, accompanied by some short-term volatility in the final days leading up to the ratification of a higher limit.

By Scott Wilson