Greetings from Harbour Capital Advisors,

Each year we share some year-end thoughts on current financial planning issues, with a focus on income tax and estate tax laws. As 2024 wraps up, it is clear there will be change ahead, although it’s too soon to know exactly what will change or when. The results of the election make it very unlikely that the more progressive tax proposals put forth by Democratic candidates in recent years will become law and more likely that at least some provisions of the 2017 tax law (the TCJA) that are scheduled to expire after 2025 will be resurrected. However, beyond these very general thoughts, there is no way to predict with certainty what will happen in the coming year. We will do our best to keep you informed as things crystalize.

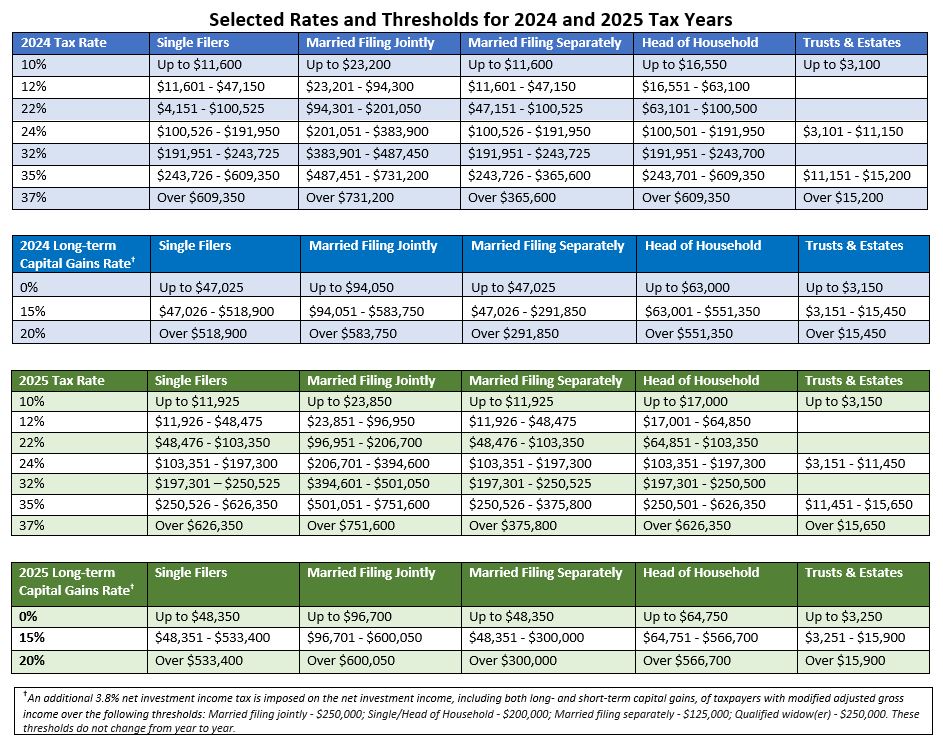

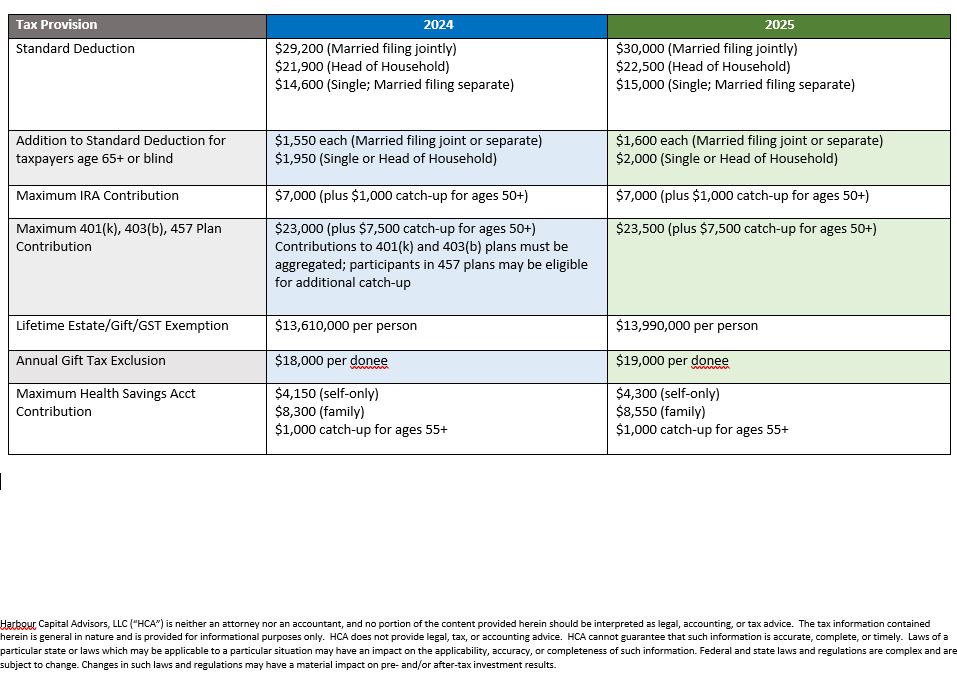

With that in mind, here are some recent developments to consider as we finish up 2024 and head into 2025, followed by a checklist of some perennial year-end planning suggestions. Please refer to the chart of “Selected Tax Rates and Thresholds for Tax Years 2024 and 2025” below that may be helpful as you consider your tax picture.

WHAT’S NEW FOR 2024-2025

- Corporate Transparency Act – As of January 1, 2024, business entities formed by filing a document with the state (e.g., corporations, LLCs, LPs) are required to report personal identification information about their “beneficial owners” to FINCEN, the financial crimes arm of the U.S. Treasury Department. Entities formed in 2024 are required to file this “beneficial ownership information” (“BOI”) within 90 days of formation, entities formed after 2024 will be required to file within 30 days of formation, and entities formed before 2024 have until Jan. 1, 2025, to make an initial filing. The law includes onerous financial and even criminal penalties for failing to report and/or update required information, so it is important for anyone with ownership or control of this type of entity to be aware of this new requirement. [See our Client Message from April 2023: Corporate Transparency Act – New Reporting Requirements.]

- Potential Sunset of TCJA – The Tax Cuts and Jobs Act enacted at the end of 2017 made significant changes to the tax code, but many were designed to expire at the end of 2025. With regard to income tax, among many changes, the TCJA expanded the standard deduction while also eliminating or limiting common deductions, resulting in fewer people itemizing deductions. It changed the tax brackets in ways that lowered taxes for many, though not all, taxpayers. With regard to the estate tax, the TCJA doubled the lifetime estate and gift tax exemption, greatly increasing the amount a person can give away during life or leave at death tax-free. Ever since the TCJA went into effect, there has been speculation about what will happen when 2026 comes – will these provisions actually be allowed to expire, will Congress step in to maintain some or all of them, or will there be new laws that would take a different approach? With the recent election results, it is unlikely that the sunset of these tax provisions will occur as scheduled, but the details and timing of legislative changes remain to be seen.

- Potential increase of SALT deduction. The TCJA capped at $10,000 the amount of state and local taxes (SALT) that taxpayers could take as an itemized deduction on their federal income tax return. While campaigning, Donald Trump expressed support for removing or raising that cap, a move that would benefit taxpayers in states with high state taxes. The SALT deduction is a controversial subject, making this change by no means definite, but it is something to watch.

- Increased lifetime estate/gift tax exemption – The amount you can give during life or leave at death without paying a transfer tax rose to $13,610,000 per person in 2024 and is scheduled to increase to $13,990,000 per person in 2025. This exemption also applies to the GST tax on generation-skipping transfers to grandchildren and subsequent generations. These exemptions are currently scheduled to be cut in half in 2026, to approximately $7 million per person, and for the last several years people have been actively strategizing how to take advantage of the greatly expanded but possibly temporary estate tax exemption. As it now seems less likely that the sunset will occur, it will be important for those with enough wealth to benefit from this larger exemption to confer with estate planners in 2025 to determine how to proceed in light of the changed political climate and attendant uncertainty.

- Increased annual gift tax exclusion – The annual gift tax exclusion, the amount you can gift to individuals each year without incurring gift tax, increased to $18,000 per person in 2024 and will rise to $19,000 in 2025.

- Using 529 plans to fund Roth IRAs – This year for the first time it is possible to roll over unused funds from a 529 plan into a Roth IRA for the plan beneficiary. There are many restrictions on this technique, but in the right circumstances, it can be an attractive option for leftover funds.

YEAR-END PLANNING REMINDERS

- Take your Required Minimum Distribution (RMD) if you have not already done so. For anyone turning 73 this year, take your first RMD by April 1, 2025. Aside from the first year, RMDs must be taken by December 31 each year. And if you delay your first RMD into 2025, be aware that you will still need to take your next RMD before the end of 2025.

- Consider Qualified Charitable Distributions (QCDs). If you are 70 ½ or older you can make contributions to qualified charities (but not to a DAF) from your IRA. The QCD will satisfy your RMD without creating taxable income for you.

- Contribute to workplace retirement accounts by December 31. If you are 50 or older consider making catch-up contributions.

- Contribute to IRAs and HSAs by April 15, 2025.

- Make gifts to family members or others to take advantage of the $18,000 per person annual gift tax exemption. Perhaps consider using this exemption to fund 529 plans for young beneficiaries. In addition, paying qualified educational and/or medical expenses in any amount on behalf of another person directly to the provider of the services is not treated as a gift for tax purposes.

- Make gifts to charity directly or through a Donor Advised Fund (DAF). Consider donating appreciated securities as a tax-efficient way to avoid paying capital gains taxes while getting a charitable deduction for the fair market value of the donated assets. Remember that charitable gifts are deductible only if you itemize deductions.

- Consider whether a Roth conversion of IRA assets is appropriate. This is a complex decision, but a key factor to consider is whether you expect to be subject to a higher tax rate when you are ready to withdraw funds (which favors conversion) or a lower tax rate (which favors leaving funds in a traditional IRA). Converting traditional IRA funds to a Roth IRA involves paying the taxes on the converted funds now, preferably with money from sources outside the IRA.

If you would like to discuss these or other year-end tax-planning issues, please don’t hesitate to reach out to your team at HCA. We would be happy to assist. Best wishes for the holiday season and the new year!

Elizabeth Hefferon