“Meh” … that has been the typical investor reaction to an allocation in international stocks for the last decade. And rightly so. We can discuss the merits of geographic diversification in equities all day long, but in recent years the chronic underperformance of this part of the market raises the question: Why even bother?

Below, a price return chart of the S&P 500 Index (U.S. stocks) vs. the MSCI EAFE Index (international developed country stocks excluding Canada and the U.S.) reflects relative performance since 2012:

Source: Bloomberg

Calling the S&P 500 price outperformance of over 150% during this period a trouncing would be an understatement. While opinions about this underperformance are many, most market gurus will tell you that asset prices during the last ten years or so were heavily influenced by stubbornly low interest rates and global deflationary pressures. These factors made U.S. stocks, specifically large U.S. tech stocks, the most compelling investments in a typical balanced portfolio.

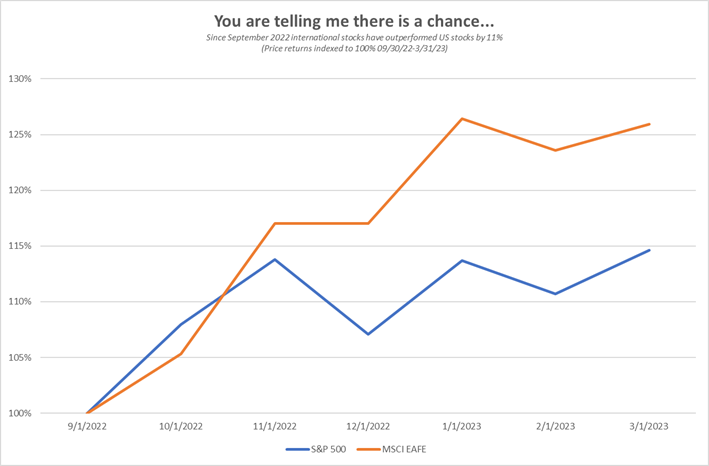

But perhaps we are seeing a trend change here. International stocks have outperformed the S&P 500 in the last six months – since the most recent equity market low in October 2022. During this period, the MSCI EAFE has outperformed the S&P 500 by ~11% – decent performance from an asset class that has been lying face down on the mat for about a decade (see chart below).

The MSCI EAFE also outperformed the S&P 500 during calendar year 2022, but both were negative. We’ll call that a partial win. Unfortunately, last year we saw record outflows from European stocks, which means, collectively, nobody owns enough of these stocks today to benefit from positive developments.

Another bright spot is Japan. Over the last twelve months (March ’22 to March ’23), the Japanese index (TOPIX) has outperformed the S&P 500 by 11% and bested it by 16% over the last two years.

We understand that the global news is, largely, terrible so it’s hard to imagine how things might improve. But stocks often look past the headlines on page A1 (if you still read an actual newspaper) and look toward other factors in the future. Many investment strategists – including ourselves – are in agreement that several factors are lining up in favor of international stocks. These include:

- Sustainably higher interest rates – historically, a higher interest rate regime benefits non-U.S. cyclical stocks.

- The dollar retreating against other major currencies – all else being equal, international stocks are worth more with a falling dollar.

- The reopening of China – this will have a positive impact on certain European stocks (e.g., France’s Louis Vuitton is going to sell more luxury items in China this year. Its stock price is doing its best imitation of a 45-degree angle – up and to the right).

- Earnings growth in some sectors abroad is stronger than in the U.S.

We believe this trend of international stocks outperforming U.S. stocks can continue and, therefore, are tactically overweight international stocks. We express this view by purchasing internationally focused ETFs and specific stocks headquartered and conducting business outside the U.S. (across Europe and developed Asia).

If you are still “Meh” on the whole topic, we will leave you with this final thought. Earlier this month, America’s favorite nonagenarian investor with a history of buying large, high-quality U.S. businesses (Apple, Coke, American Express…) traveled to Japan. Why? To invest in Japanese companies. Clearly something these days is compelling Mr. Buffett to look beyond U.S. borders and increase his stakes abroad.