Inflation has been an unhappy development for all of us in 2022. But in fact, there are ways inflation can work in our favor. Both the IRS and Social Security adjust rates and benefits annually based on changes in consumer prices to help cushion the effects of inflation. Specifically, the IRS makes annual inflation adjustments to more than 60 tax provisions, and the Social Security Administration increases benefits through yearly cost of living adjustments (“COLAs”).

Our recent elevated inflation experience has led to exceptionally large changes for 2023. The following is a preview of some benefits you can expect next year (beginning in January 2023 and reflected in April 2024 tax returns filed). For just the numbers, please reference the summary chart at the end of this article.

Income Tax

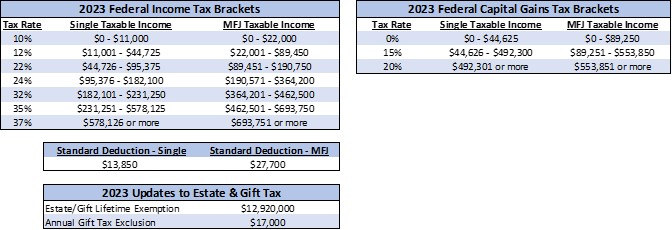

Last month the IRS announced inflation adjustments of just under 7% for tax year 2023*. A key purpose of the IRS adjustment is to shift tax brackets upwards to avoid the “bracket creep” of inflation pushing income into higher tax brackets. The current tax rates – 10%, 12%, 22%, 24%, 32%, 35% and 37% – won’t change for 2023, but it will take more income to push you into the next bracket. For example, in 2022, the top 37% bracket applied to single filers with income above $539,900 and to married couples filing jointly with income above $647,850. In 2023, taxpayers won’t reach that 37% bracket until income exceeds $578,125 (single) or $693,750 (joint).

Similarly, capital gains tax brackets will remain the same – 0%, 15% and 20% – but taxpayers will be able to realize more capital gains in each bracket before moving to the next. In 2023, the 0% bracket will shelter an additional $3,000 in capital gains for single taxpayers and $6,000 for those filing jointly. On the other end, it will take an additional $32,000 (single) or $36,000 (joint) of capital gains to reach the top 20% bracket.

Since the elimination of most itemized deductions in 2018, most taxpayers use the standard deduction. In 2023, the standard deduction will rise by $900 for single filers (to $13,850) and $1,800 for married couples (to $27,700). Other income tax provisions that will adjust upward for inflation include the AMT exemption, contribution limits for many retirement plans, contributions to health savings accounts and flexible spending accounts, and the child tax credit.

Estate/Gift Tax

The federal estate/gift tax lifetime exemption will rise to $12.92 million for 2023. A married couple with appropriate planning will be able to transfer up to $25.84 million by gift or at death without transfer tax. This exemption is currently scheduled to be cut in half in 2026. In the meantime, this historically large increase provides an opportunity to pass significant wealth to the next generation through timely lifetime gifts. In addition, the annual gift tax exclusion will increase by $1,000, allowing you to make gifts up to $17,000 ($34,000 as a married couple) a year to as many people as you choose beginning in January 2023.

Social Security

Social Security calculates its COLAs using the Consumer Price Index for Urban Wage Earners and Clerical Workers (“CPI-W”), which results in a higher inflation adjustment than the IRS rate. Social Security benefit payments will rise by 8.7% in 2023, the largest increase in more than 40 years! On the other hand, for those still in the workforce, the maximum amount of earnings subject to Social Security tax will increase from $147,000 to $160,200, showing that inflation adjustments can cut both ways.

While this is a high-level summary of tax rates and benefit levels for 2023, hopefully it provides some insight into the rationale and mechanics behind the annual changes to those numbers and a chance to dwell for a few minutes on a brighter side of the complexities of living with increased inflation. We are happy to arrange a time to discuss these changes as they relate to your personal financial situation in greater detail.

By Elizabeth R. Hefferon

*The IRS calculates inflation using the “chained CPI”, which takes into account consumers’ changing consumption patterns as a result of changing prices, recognizing that consumers spend less and make different choices as inflation makes items more expensive. This produces a slightly lower rate of inflation than the basic consumer price index (CPI).

Just the Numbers…

Just for Fun…