MAY 2022: Flashback to 2020: you are living through a real-life pandemic lockdown. You are confined to your home, binge watching Netflix shows, ordering a year’s worth of toilet paper from Amazon, stocking up on IPads and laptops for home schooling and work-from-home, and spending an unhealthy amount of time on Facebook. Little did you know that your consumer behavior was driving a concentration of stock market returns of top technology companies to a peak of Mt. Olympus-like proportions.

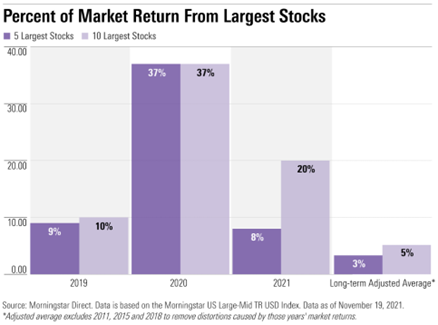

In fact, the five largest stocks (Apple, Microsoft, Amazon, Meta/Facebook, and Tesla) contributed to 37% of the market’s returns in 2020. By comparison, from 2009 to 2019, the five largest stocks contributed an average of 3% of the market’s returns, as seen in the following chart from Morningstar:

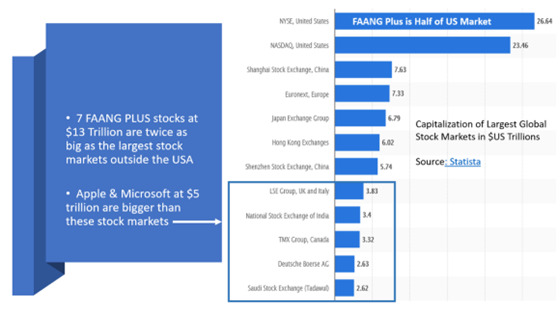

The pre-pandemic digital transformation trends were accelerated by Covid-19, catapulting these market leaders into true mega cap stocks. For instance, look at the “FAANG Plus” stocks (Facebook/Meta, Amazon, Apple, Netflix, Google/Alphabet, and Microsoft) relative to the capitalization of some of the largest stock markets in the world, as seen in the chart below:

While this may trigger thoughts of the dotcom tech bubble of the late 1990s, today’s technology stocks have notable advantages, including strong profitability, significant competitive barriers, above average growth prospects, and robust balance sheets.

However, global central banks’ intentions to raise interest rates to contain inflation have created heightened volatility in the stock market of late. Despite strong fundamental characteristics for specific technology names, the reversal of the easy-money policies has led to a significant correction in this sector across the board. Furthermore, we have seen the outperformance of some of these top stocks diminish because of inflation-driven economic headwinds, normalized competitive dynamics, and a return to slightly more recognizable habits of an economy that is more open than closed.

This is not to say that investors should avoid holding these stocks in their portfolios – we believe they should. But one must recognize that the concentration has been increasing significantly in these technology names, which can add idiosyncratic risk to a benchmark fund while amplifying bias toward certain sectors.

As with everything in which we invest, we monitor these large technology names closely and incorporate them into a granular portfolio that is actively managed. In addition, we strive to minimize portfolio volatility through thoughtful diversification across multiple asset classes.

We think the combination of this increasing stock market concentration of top tech names coupled with recent market volatility illustrates why an active strategy is superior to a passive one. For example, if you held the Vanguard S&P 500 ETF at the end of Q1’22, you would have held a 22.2% exposure to Apple, Microsoft, Google/Alphabet, Amazon and Meta/Facebook, collectively. If you wanted to trim that exposure, you could only do so by selling the entire index ETF. Through active equity management, HCA can make both strategic and tactical moves to protect client portfolios from outsized holdings and seek to minimize related market fluctuations while maximizing tax efficiency.

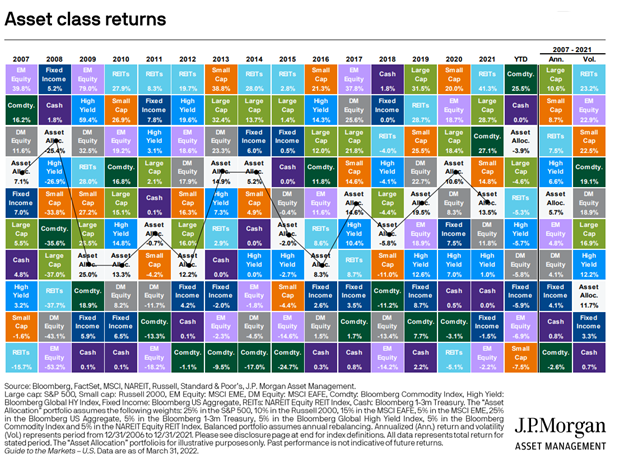

You can also minimize the impact of this large cap concentration trend through investing in other equity markets, including domestic small/mid cap stocks, international developed stocks, and emerging markets. Small cap stocks and emerging markets have experienced years of outperformance historically, and it is important to hold a diversified portfolio that is positioned to benefit from the ever-changing relative performance among asset classes. You can see this dynamic in the chart below, which depicts asset class returns by year (the columns) with the top performers in the top row – (REITs, small cap stocks and emerging markets equities were top performers in three or more of the past 15 years, respectively).

Finally, we believe that the last few months can be viewed as a subtle endorsement for alternative assets, which include private equity, venture capital, private real estate debt and equity, hedge funds and private credit (lending to privately-held businesses). Private investments can drive higher returns and lower volatility for a diversified portfolio, resulting in better efficient frontier characteristics and improved client outcomes. At HCA, depending on client circumstances and subject to certain qualifications, we may include alternative assets like these in a client portfolio.

In conclusion, the last two years of intermittent lockdowns, never-ending Zoom meetings, and limited activities and socialization forced us to adapt to a new reality. As the pandemic shifts to an endemic phase, this collective experience will stay with us and some of the changes to our daily lives have become true cultural shifts, such as hybrid work.

The stock market, which often reflects the economic realities of our day-to-day lives, will shift as well. Equity market trends can sometimes lull investors into a state of complacency and certainty. Then, just when it feels like these trends are unstoppable, the equity market can transition abruptly to a new regime and new leadership, which can lead to short-term periods of volatility.

Active management allows an investor to be nimble in response to identifiable situations of overallocation to certain sectors. Not putting all your (ostrich) eggs in one basket is a cliché for a reason. Diversification can improve portfolio returns, reduce volatility and drawdowns, and allow investors to take advantage of emerging trends.

By Allison Dunlap and Nick Bundy