Greetings from Harbour Capital Advisors,

Let me start this year-end letter by noting that 2023 has been a relatively uneventful year for individual income tax and estate tax laws. Ironically, the current divisiveness in Congress has led to relative stability in the tax system. As a result of our split government, it is unlikely (although not impossible) that there will be major tax law changes before the next administration and Congress take office in 2025. Many changes made by the Tax Cuts and Jobs Act (TCJA) at the end of 2017 are scheduled to sunset by 2026, but for now those provisions are firmly in place.

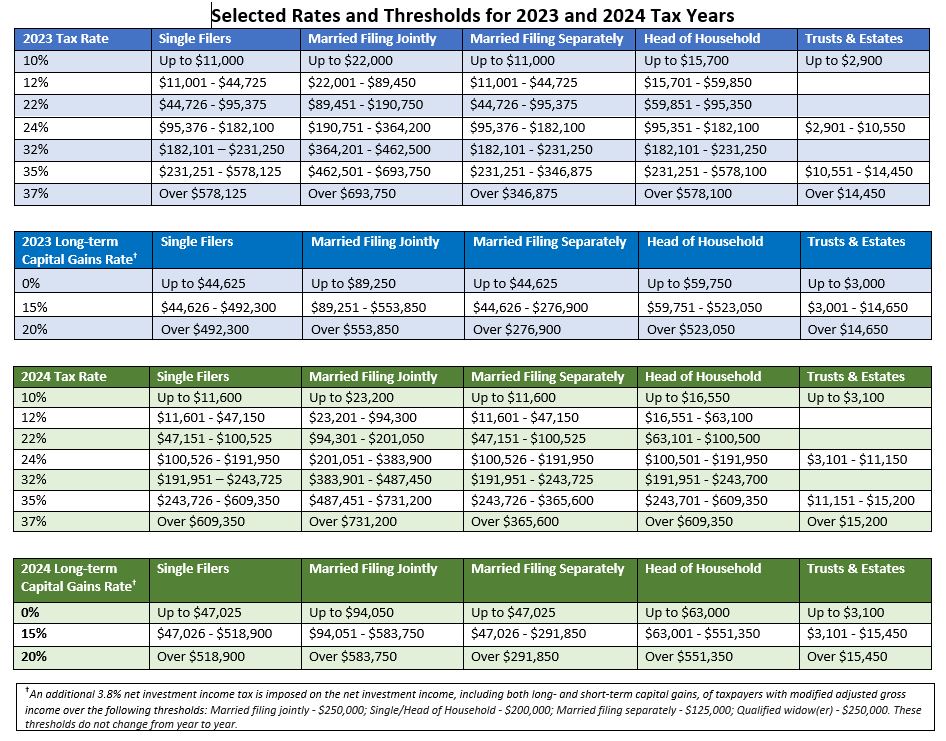

That kind of certainty, rare in recent years, is beneficial for tax planning. To help with your planning, here are some recent developments to be aware of as we finish up 2023 and head into 2024. Please refer to the attached chart of “Selected Tax Rates and Thresholds for Tax Years 2023 and 2024” that may be helpful as you consider your tax picture.

WHAT’S NEW FOR 2023-2024

Inflation adjustments – One happy side effect of recent inflation is that government rates designed to adjust based on inflation have increased significantly. Income tax brackets for ordinary income and capital gains have risen – each bracket begins at a higher level of income than it did the year before, meaning that more income is taxed at lower rates. The attached chart shows the bracket increases for 2023 and 2024, as well as helpful increases in other important tax provisions. [See our recent Client Message for further details: Turning the Page – 2023 Tax and Social Security Adjustments.]

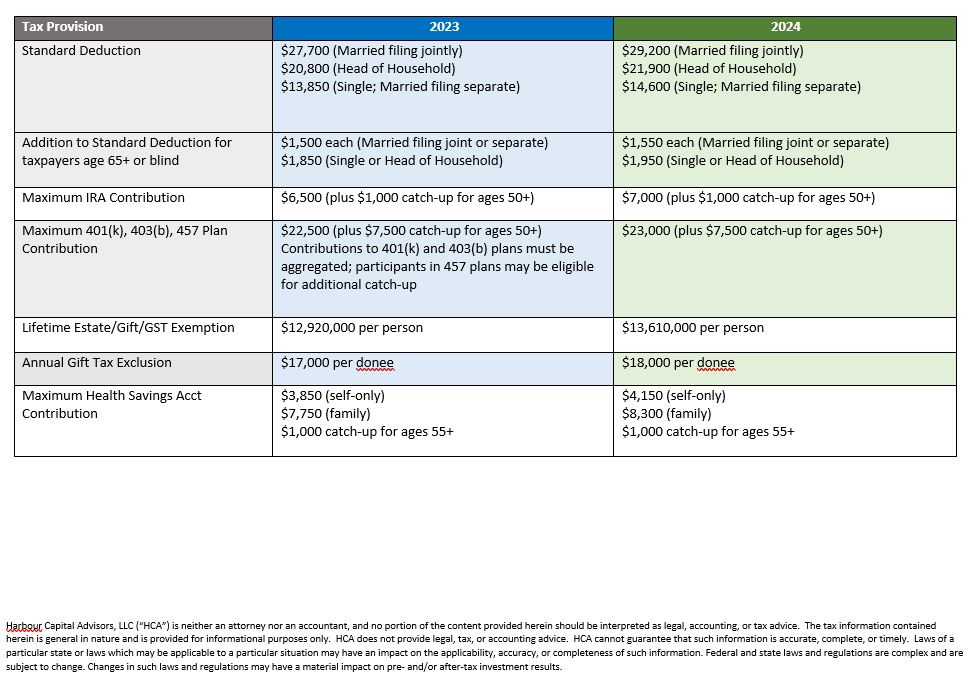

Increased lifetime estate/gift tax exemption – The amount you can give during life or leave at your death without paying a transfer tax has risen to $12,920,000 per person in 2023 and is scheduled to increase to $13,610,000 per person in 2024. This exemption also applies to the GST tax, a separate tax on generation-skipping transfers to grandchildren and subsequent generations. These exemptions are scheduled to be cut in half beginning in 2026, to approximately $6-7 million per person. For those with enough wealth to take advantage of the current higher exemptions, the coming year should be a good time to do estate and gift planning.

Increased annual gift tax exclusion – The annual gift tax exclusion, the amount you can gift to individuals each year without incurring gift tax, increased to $17,000 per person in 2023 and will rise to $18,000 in 2024. In addition, paying qualified educational and/or medical expenses in any amount on behalf of another person directly to the provider of the services is not treated as a gift for tax purposes. Taking regular advantage of these “use it or lose it” opportunities each year can transfer significant wealth to your loved ones and help to reduce your potentially taxable estate without gift tax concerns.

Increased contribution limits – Consider the effect of inflation adjustments on contribution limits for workplace retirement plans such as 401(k), 403(b) and 457 plans, as well as Health Savings Accounts, and Flexible Spending Accounts. These thresholds are included in the attached chart of Selected Rates and Thresholds referenced above. Be sure that you are maximizing your contributions if that is your intent.

Using 529 plans to fund Roth IRAs – Beginning in 2024, it will be possible to roll over unused funds from a 529 plan into a Roth IRA for the plan beneficiary. There are many restrictions on this technique, but in the right circumstances, it can be an attractive option for leftover funds.

Corporate Transparency Act – Beginning in 2024, business entities formed by filing a document with the state (e.g., corporations, LLCs, LPs) will be required to report personal identification information about their “beneficial owners” to FINCEN, the financial crimes arm of the U.S. Treasury Department. Entities formed in 2024 are required to file this information within 90 days of formation, entities formed after 2024 will be required to file within 30 days of formation, and entities formed before 2024 will have until the end of 2024 to make an initial filing. The law includes onerous financial and even criminal penalties for failing to report and/or update required information, so it is important for anyone with ownership or control of this type of entity to be aware of this new requirement. [See our Client Message from April for further details: Corporate Transparency Act – New Reporting Requirements.]

Changes to IRA rules on RMDs – The age at which an individual must begin taking annual required minimum distributions (RMDs) from IRAs has been climbing – to 73 as of 2023, increasing to age 75 in 2033. In addition, the penalty for failing to take an RMD has now decreased from 50% of the missed distribution to 25%, (10% if timely corrected).

If you would like to discuss these or other year-end tax-planning issues, please don’t hesitate to reach out to your team at HCA. We would be happy to assist. Best wishes for the holiday season and the new year!

Elizabeth Hefferon