As 2022 is coming to an end, we offer some observations about the current tax, charitable and estate planning landscape, along with some year-end planning suggestions.

After several years of historically low interest rates, low inflation and a strong stock market, 2022 has brought rapidly increasing interest rates, a return of inflation and challenging market conditions. On the other hand, 2022 has been surprisingly stable on the tax front. Last year’s worries about legislative proposals to increase taxes on the wealthy and change many estate and gift tax rules were not realized. Instead, this year brought passage of the Inflation Reduction Act, which has little direct income tax impact on individual taxpayers. Its most significant tax-related provision affecting individuals may be the increased funding for the IRS, which is likely to increase tax enforcement, particularly for taxpayers with income over $400,000 a year, making it more important than ever to follow the rules and pay attention to details when doing tax planning. Greater funding for customer service and updated automation intended to make the IRS more efficient and responsive to taxpayers should be welcome news for anyone who has tried to get through to the IRS by phone or get help untangling a tax problem.

The split-government results of the 2022 midterm elections make radical changes to the tax code in the next two years unlikely (though never impossible). As we get closer to 2026, it is important to remember that many provisions of the 2017 Tax Cuts and Jobs Act (“TCJA”) are scheduled to expire at the end of 2025 and revert to prior law. Consequences would include reducing the standard deduction, bringing back the personal exemption, reinstating some itemized deductions and removing TCJA limitations on others (such as the state and local tax and mortgage deductions) and a return to higher individual income tax rates. The federal estate tax exemption, currently $12.06 million per person for 2022, is scheduled to be cut in half. For those who want to take advantage of current law, particularly regarding estate and gift tax, it is time to start planning, and the prospect of relative predictability in the near future is welcome. In addition, the current market downturn and inflation adjustments to tax brackets and entitlements like Social Security may provide some unexpected opportunities. [See our recent Client Message for further details: https://harbourcapitaladvisors.com/turning-the-page-2023-tax-and-social-security-adjustments/ ]

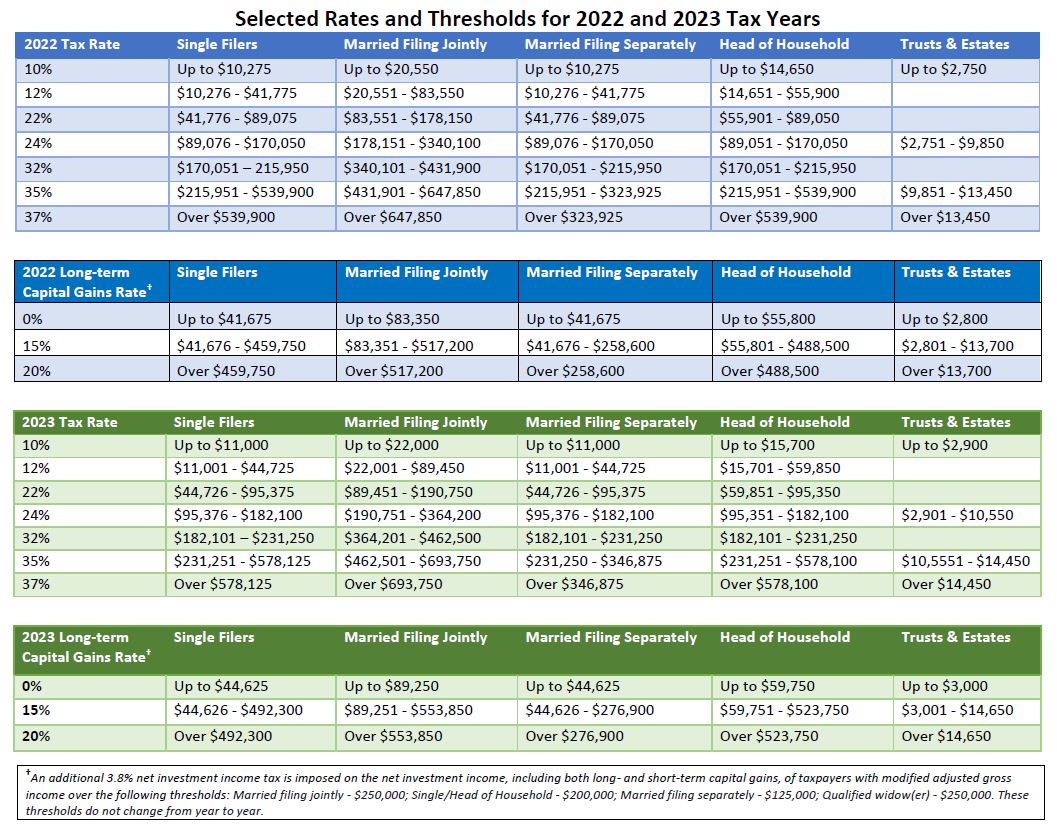

Below is a list of selected year-end tax, estate planning and charitable techniques, some new for 2022 and some that are worth repeating year after year, updated here to reflect current circumstances, along with a chart of “Selected Tax Rates and Thresholds for Tax Years 2022 and 2023” that may be helpful for your planning.

INCOME TAX PLANNING

- Take Required Minimum Distributions (RMDs). Be sure to take your RMDs for 2022 from traditional IRAs before the end of the year. Under current law, you must take your first RMD in the year you turn 72 or by April 1 of the following year (in which case two RMDs are required that year). Bipartisan legislation now under consideration in Congress (with possible passage before the end of the year) could raise the initial age for beginning RMDs to 75 in future years. If and when that legislation becomes law, we will keep you informed.

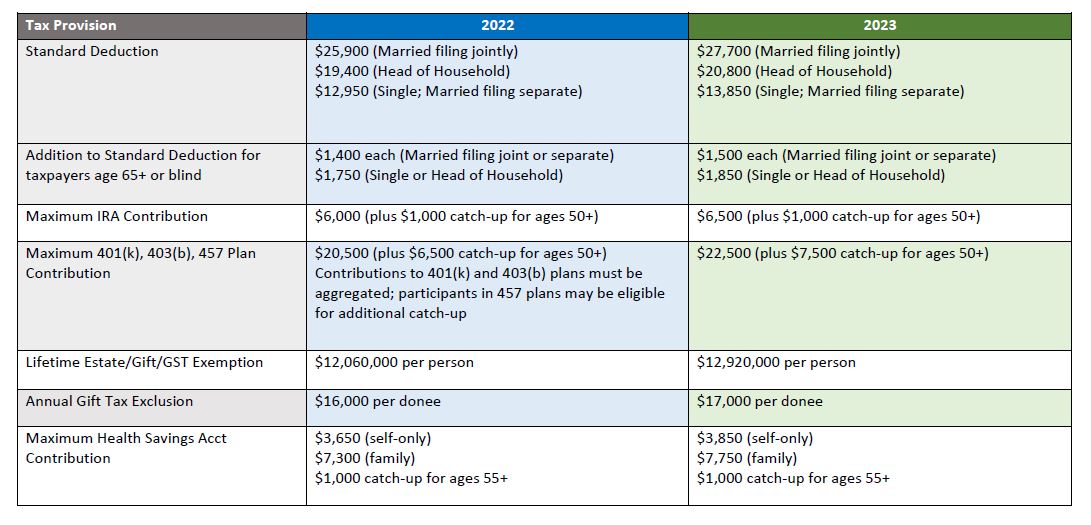

- Maximize retirement plan savings. If you haven’t made the maximum contribution to your workplace retirement plan or IRA, consider increasing your contribution. Those age 50 or older are eligible for an added catch-up contribution amount annually. 401(k) contributions must be made by the end of the year, but you can make a 2022 contribution to an IRA until April 18, 2023. See the chart below for contribution limits for 2022 and 2023. Increased inflation means that contribution limits will increase significantly in 2023.

- Harvest tax losses. Given the market downturn, this may be a particularly good year to minimize taxable capital gains by selling underperforming assets to generate a capital loss that can offset capital gains. Beware of the wash sale rule which prohibits selling a security at a loss and buying the same or a similar security within 30 days before or after the sale. Harbour Capital Advisors actively harvests losses in client portfolios. If you have specific questions regarding your year-to-date realized gain/loss position, please give us a call.

- Consider Roth Conversions. If you cannot contribute directly to a Roth IRA because of your income level, you may consider converting a traditional IRA (or part of one) to a Roth. A Roth IRA grows tax-free like a traditional IRA but there are no RMD requirements and withdrawals are tax-free. A major disadvantage is that you must pay income tax on the amount converted in the year of conversion and to make the conversion worthwhile you should pay that tax from funds outside of the IRA. The decision to do a Roth conversion requires a detailed assessment of circumstances, most importantly whether you expect to be in a higher or lower tax bracket when you withdraw the assets than you are now.

ESTATE AND GIFT PLANNING

- Make gifts. The annual exclusion from the gift tax for 2022 is $16,000 per person per donee, scheduled to increase to $17,000 in 2023. In addition, paying qualified educational and/or medical expenses in any amount on behalf of another person directly to the provider of the services is not treated as a gift for tax purposes. Taking regular advantage of these opportunities each year is a simple and effective way to pass assets to your loved ones without gift tax concerns. The consecutive increases in the annual exclusion in 2022 and 2023 greatly enhance this opportunity. In addition, gifting securities while prices are down but expected to rebound over time can increase the long-term benefit of the gift.

- Fund 529 plans. A popular way to make gifts to younger family members is to fund 529 plans for their education. Funds in a 529 plan grow tax-free; withdrawals are tax-free if used for approved educational expenses; and many states give a state tax deduction for contributions. In addition to college and graduate school tuition, you can now use funds in a 529 plan (i) to pay up to $10,000 per year for elementary or secondary school tuition and/or (ii) to repay qualified education loans of a plan beneficiary and the beneficiary’s siblings up to a lifetime limit of $10,000 per person.

- Intra-Family Loans. Making loans to family members has been extremely advantageous in recent years because of historically low interest rates. While rates have climbed this year, the minimum interest rate that the IRS requires you to charge for intra-family transactions generally continues to be lower than commercial rates and loaning money to children and grandchildren may still be a beneficial option.

- Consider using current expanded estate/gift/GST tax exemptions. The estate and gift tax lifetime exemption for 2022 is $12.06 million per person and is predicted to be $12.92 million in 2023. The exemption is slated to sunset at the end of 2025 and return to something closer to $6 million. Those with large taxable estates should continue to explore ways to lock in this larger exemption through life-time gifting. Anyone who has already used their entire exemption and has sufficient wealth should consider ways to utilize the annual inflation-adjusted increases from now through 2025.

CHARITABLE PLANNING

- Bunch charitable deductions or consider donating to a donor-advised fund (DAF). Because the current large standard deduction and limited itemized deductions can make it hard to get any tax benefit for your regular annual charitable donations, it may be more tax-effective to bunch your donations by making several years’ worth of donations in a single year in order to exceed the standard deduction. You would then refrain from giving to charity for the following year or two and take the standard deduction. Another way to accomplish a similar result is by establishing a donor-advised fund (DAF). Several of our clients have found this to be an efficient and tax-effective way to bunch their charitable giving. Consult with your accountant to find out if either of these approaches would benefit your tax situation.

- Make Qualified Charitable Distributions (QCDs). Taxpayers over age 70 ½ can make donations to public charities directly from their IRAs up to an annual total of $100,000. For those required to take RMDs, a QCD will qualify as an RMD, allowing you to avoid inclusion of that amount in your income for income tax purposes and for calculations based on AGI, such as Medicare premiums and taxation of Social Security benefits.

- Expiration of CARES Act Charitable Deduction Rules. In response to Covid, in 2020 and 2021 the CARES Act provided (i) an above-the-line charitable deduction allowing people who did not itemize to take a small deduction for cash donations to public charities (the exact rules varied from one year to the next, but it was basically a $300 per person deduction) and (ii) for taxpayers who did itemize, the ability to deduct up to 100% of their AGI for cash donations to public charities rather than the usual 60% of AGI limit. These options are not available in 2022.

- Pay attention to rules on charitable donations. Several developments this year have signaled the IRS’s intent to insist on strict adherence to rules for substantiating charitable giving. It is important to pay attention to the rules regarding valuation of non-cash gifts; make gifts in time so that they are complete by year end; and be sure you receive and retain timely written acknowledgment of donations from recipient charities.

If you would like to discuss these or other year-end tax-planning strategies, please get in touch with us; we would be happy to talk with you. In the meantime, we hope that the chart below of current and future tax rates may help you assess your tax picture and plan for the coming year.

By Elizabeth R. Hefferon